Run the payroll, please. Compliance is automatic and built-in!

All of your compliance obligations toward local and federal authorities are handled by Ojoor Payroll Software in Saudi Arabia. You don’t have to do any of the tedious labor because it is entirely automated.

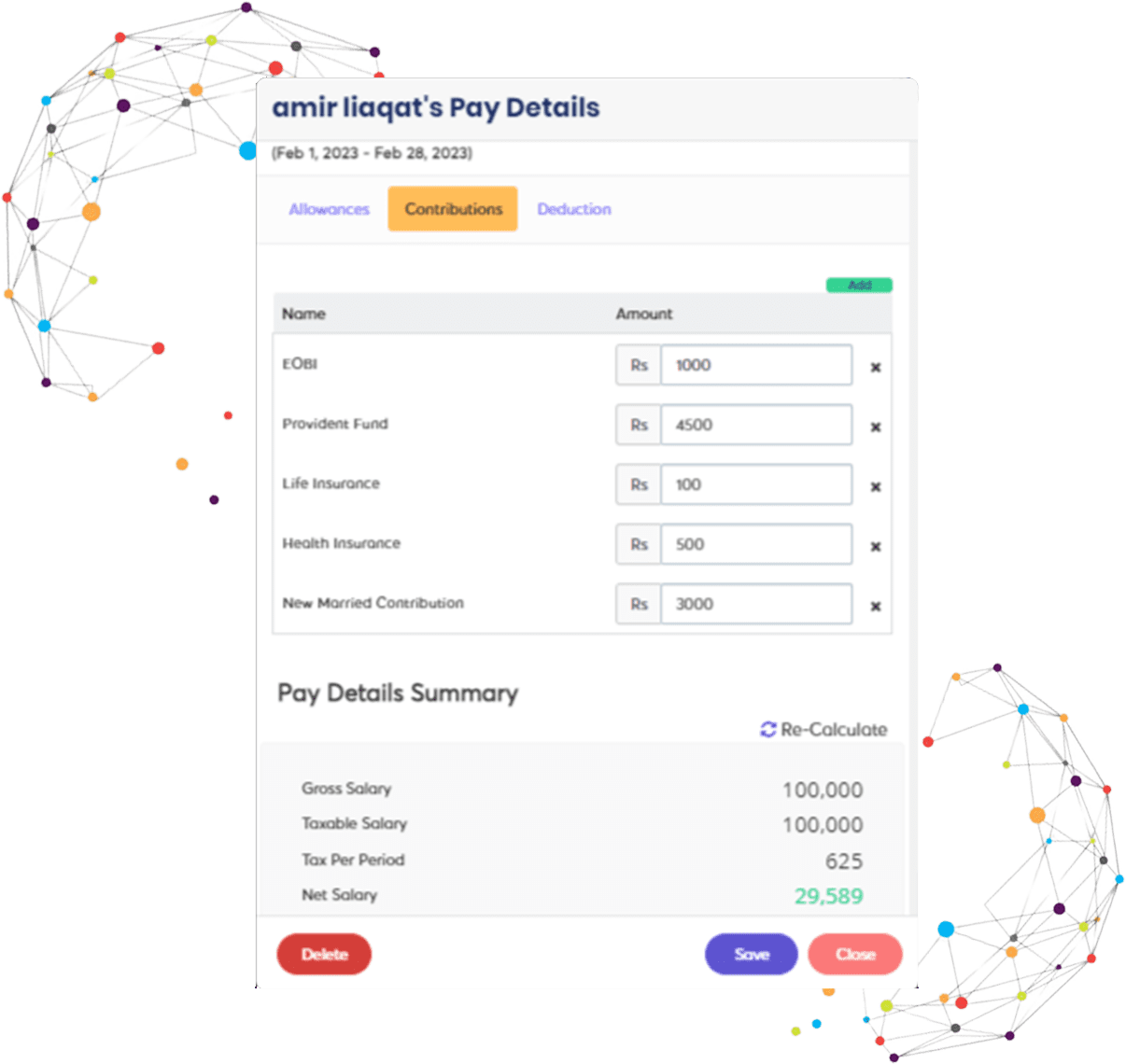

PROVIDENT FUND COMPLIANCE

Calculations for PF with automatic filing input

You can build up your provident fund regulations using Ojoor Payroll Software in Saudi Arabia based on management bands or employee wage ranges. Set up the provident fund to be included in the CTC or excluded from it, and Ojoor will do all the arithmetic. We will create the electronic file format at the conclusion of payroll.

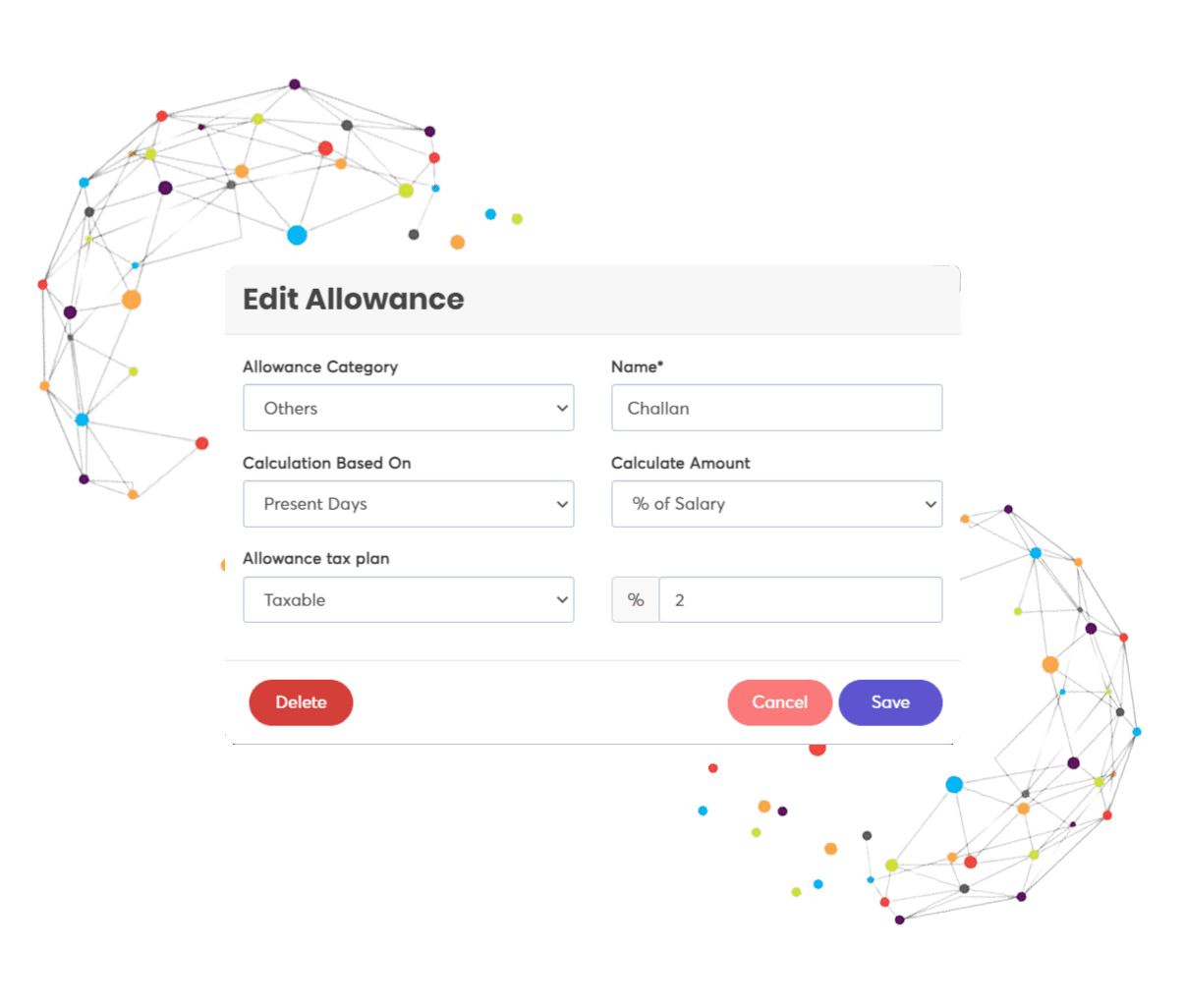

ESI COMPLIANCE

Calculations using ESI and filing challans electronically

Using Ojoor payroll and HR Software in Saudi Arabia, set up ESI application and computation criteria for your full-time and hourly workers. Automatic production of filing outputs that adhere to ESI office norms is done by Ojoor.

LEGISLATIVE TAX COMPLIANCE

Professional Tax that incorporates your state’s specific rules

Each state has its own professional tax calculation and compliance paperwork. All of these variants are made easier via Ojoor. It prepares compliance paperwork for each state and automatically deducts professional tax. To handle your complex cases, you can still modify the rules.

With the support of Ojoor, we were able to manage our 15,000 employees with simplicity, which was a significant step forward in our digital transformation path.

Tufail Gill

Vice President HR

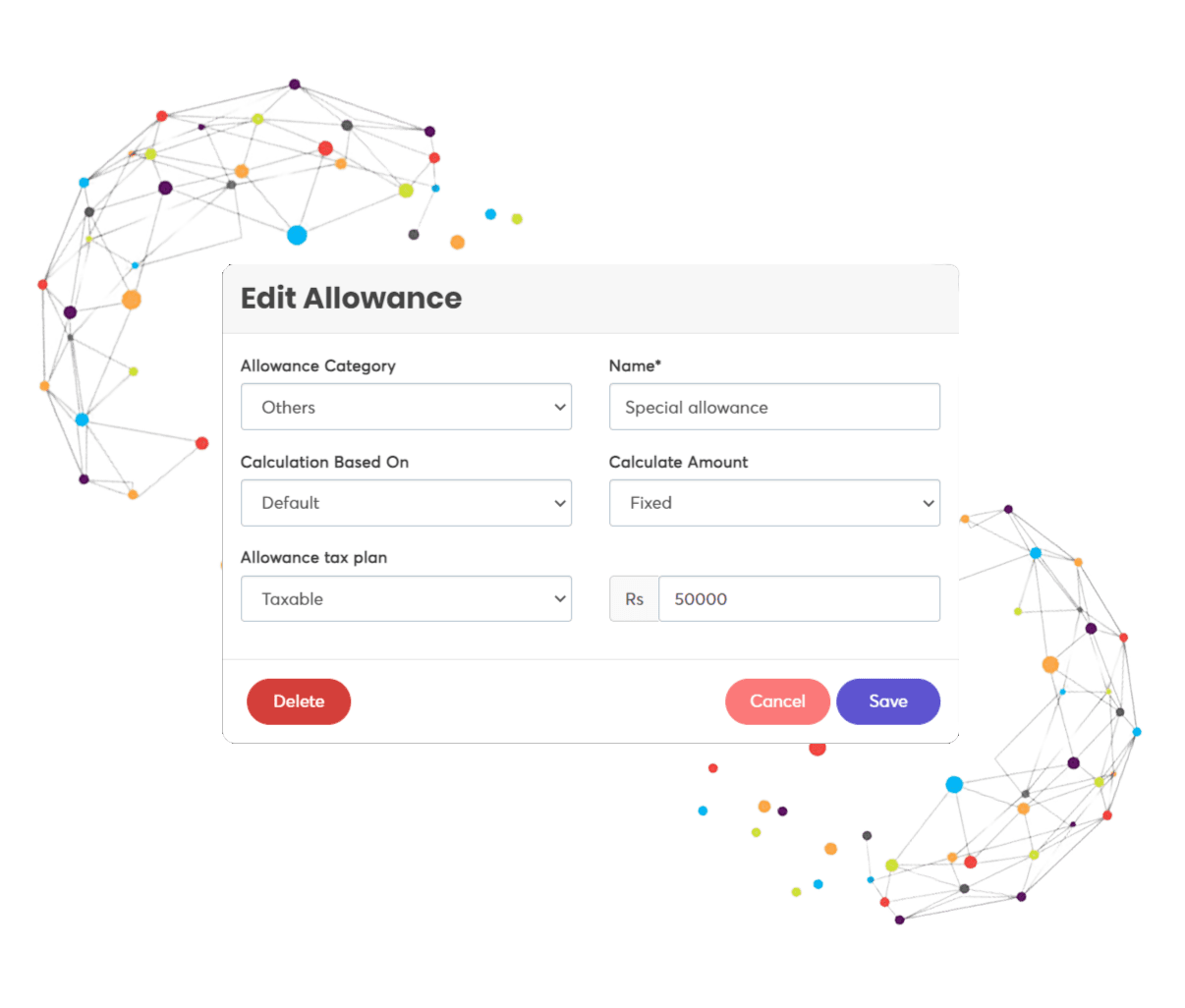

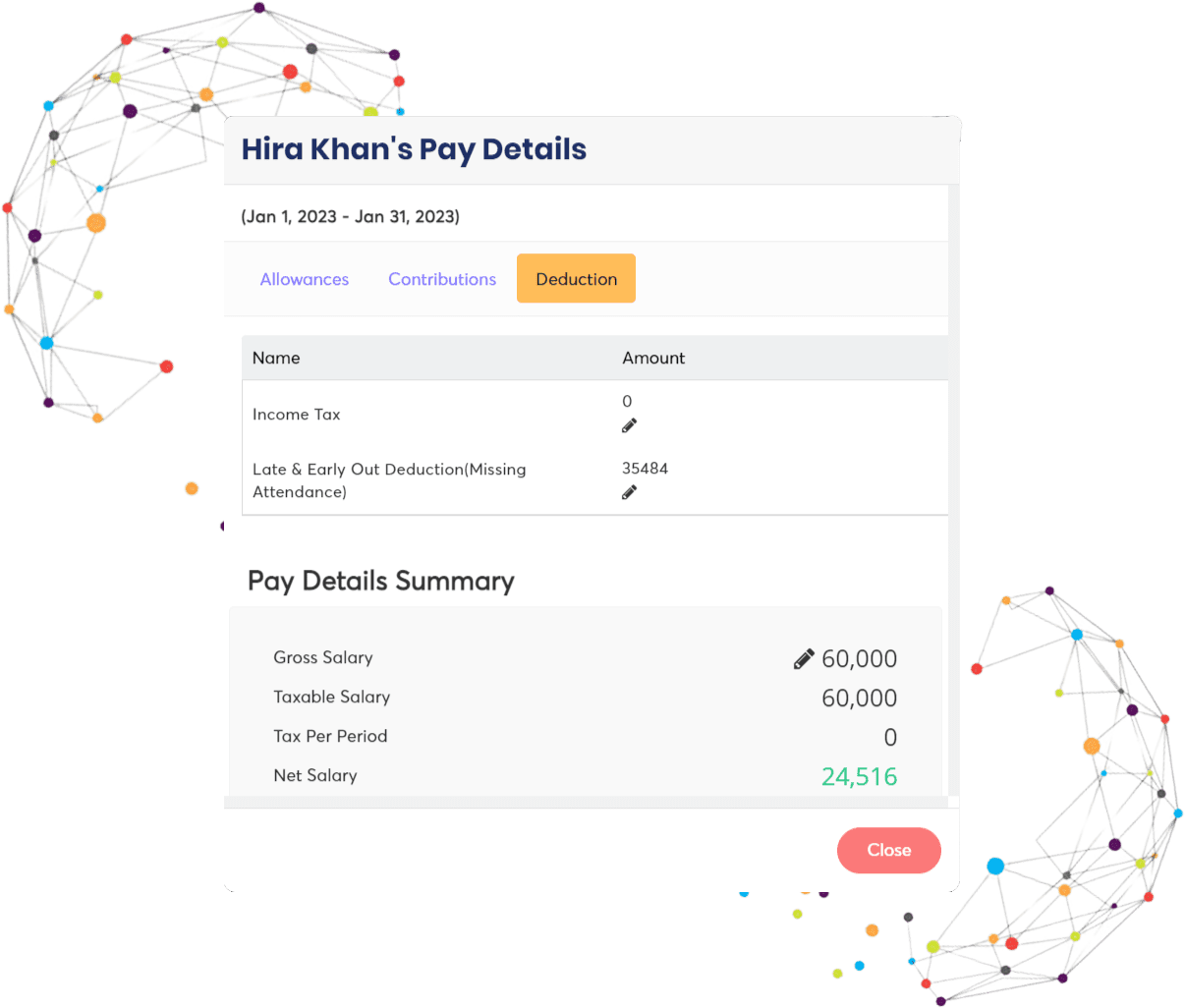

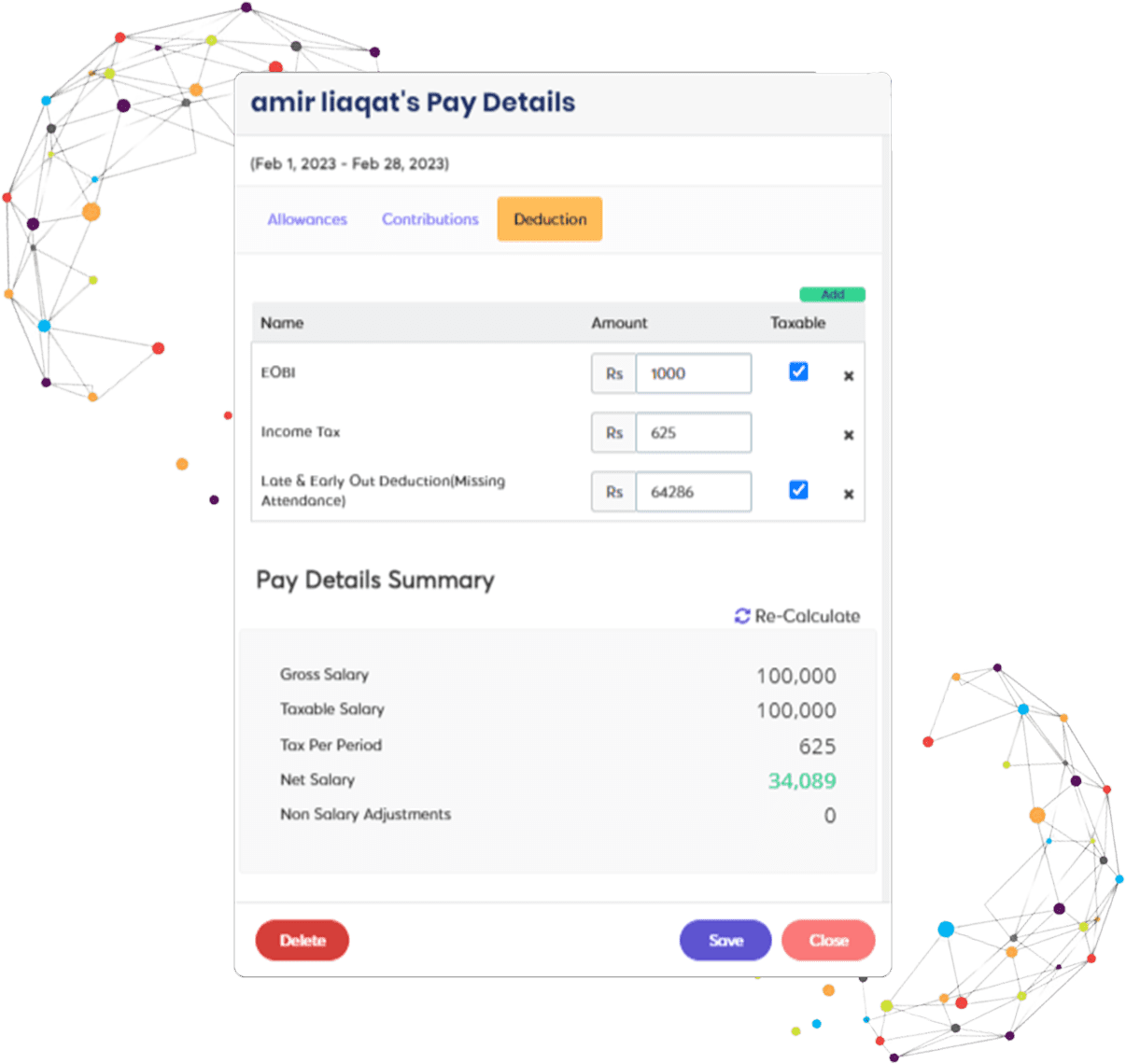

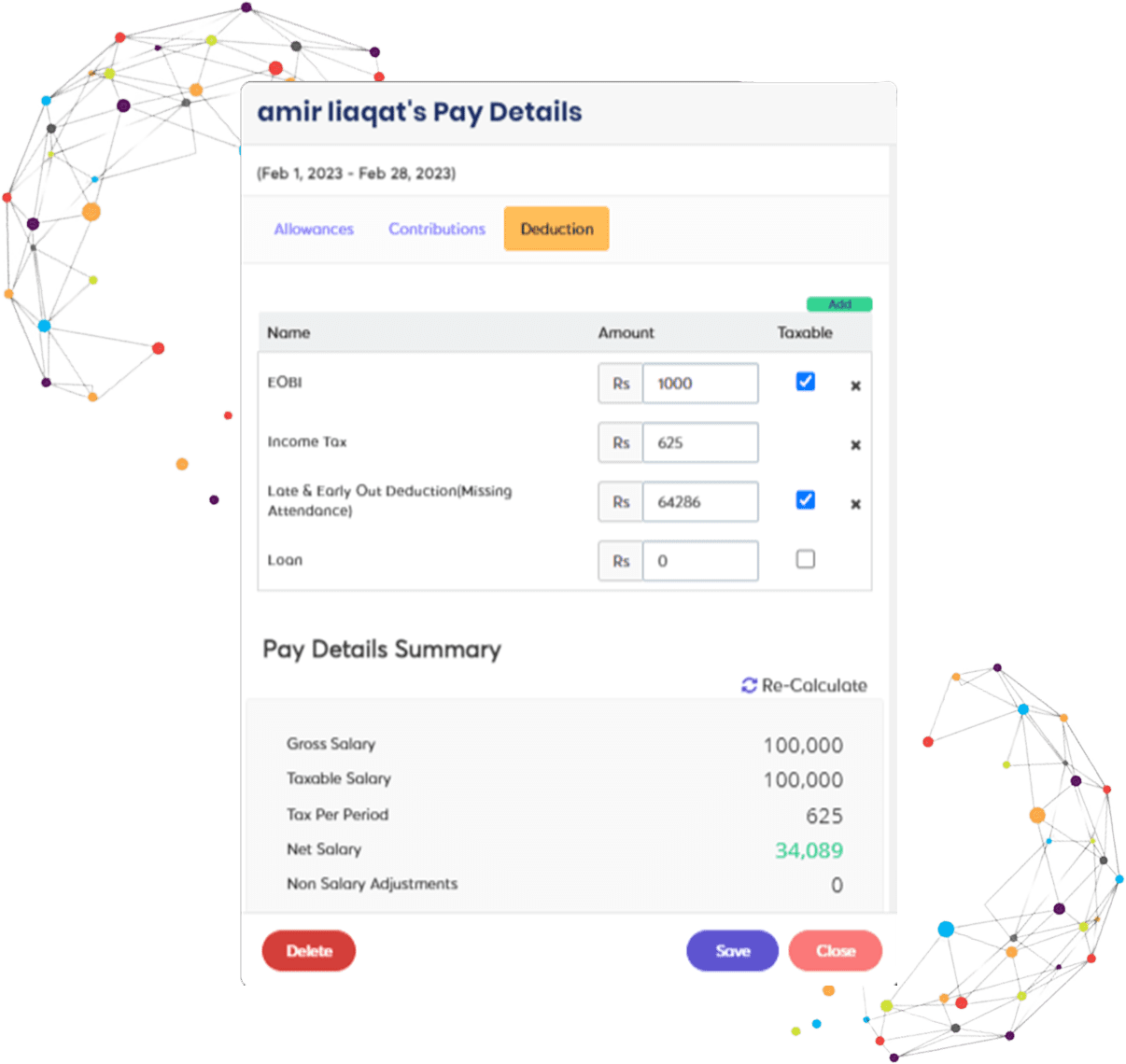

INCOME TAX COMPLIANCE

TDS (IT) computations that are thorough and eTDS returns

Ojoor divides up your allowances and deductions according to the sections required by the IT department and generates TDS filing statements and challans for you to submit electronically.

FILINGS FOR INCOME TAX DEDUCTIONS

Automatic FVU validation and one-click Form 24Q generation

You must submit the returns every quarter in the required electronic format, per the IT department’s requirements. Thanks to Ojoor HR Analytics software in Saudi Arabia, everything is automatic.

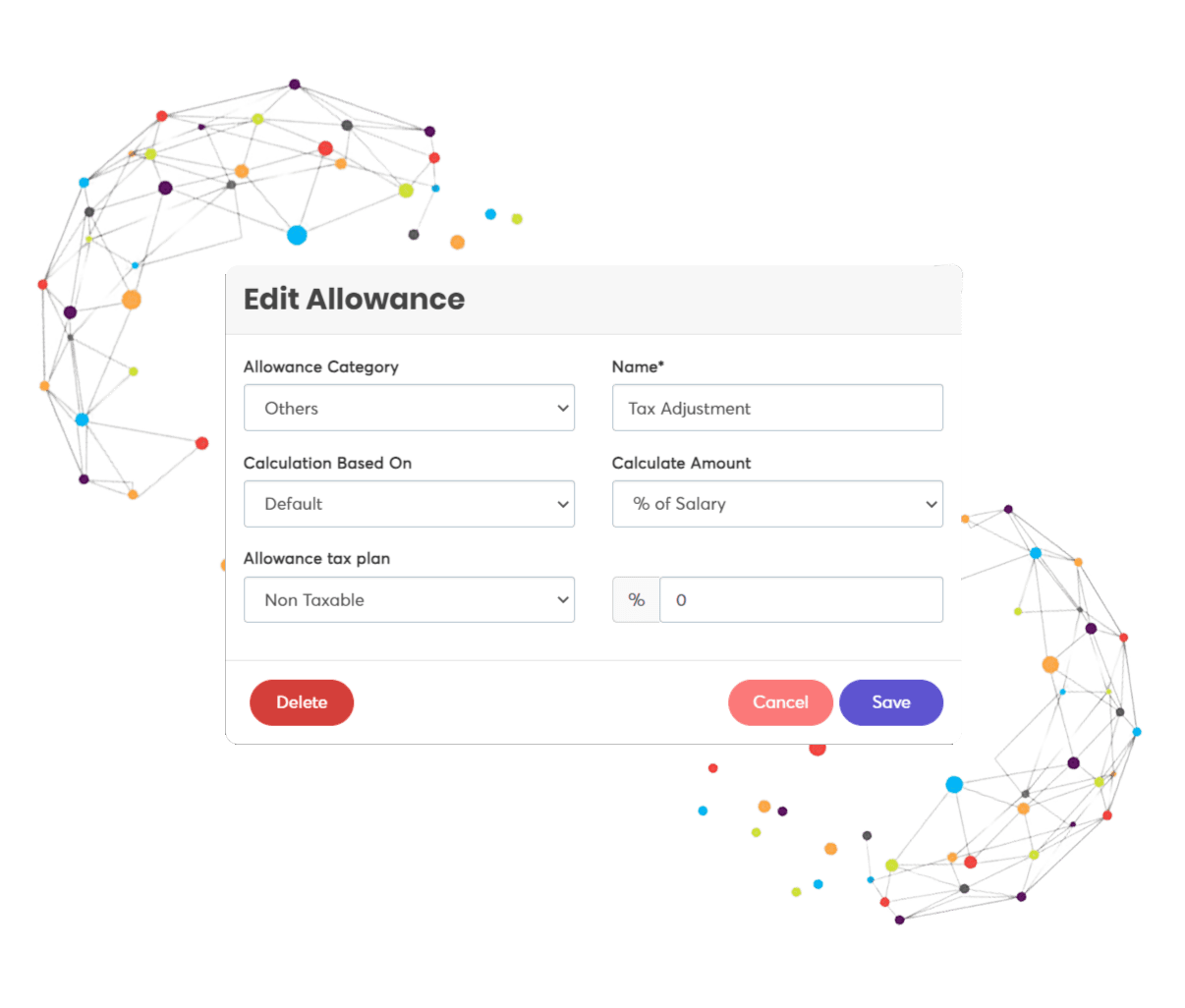

TAX DEDUCTION ADJUSTMENTS

Tax deductions that are prorated to account for wage reductions, bonuses, tax declarations, etc.

Ojoor makes sure that tax deductions are accurate within a specific fiscal year notwithstanding adjustments to salaries, bonuses, leave encashments, or lost wages. so that they can earn the highest take-home pay while abiding by the law.

FUND FOR LABOR WELFARE

Coverage of LWF contributions across all states

Contributions to labour welfare funds are required in some states. Ojoor will assist you in calculating the computations and the filing requirements automatically because they differ for each state.